Whole Life Insurance: What is it?

Life insurance is often only seen as a form of protection, but it holds untapped potential for wealth generation.

Get acquainted with the most unknown yet powerful financial tool available.

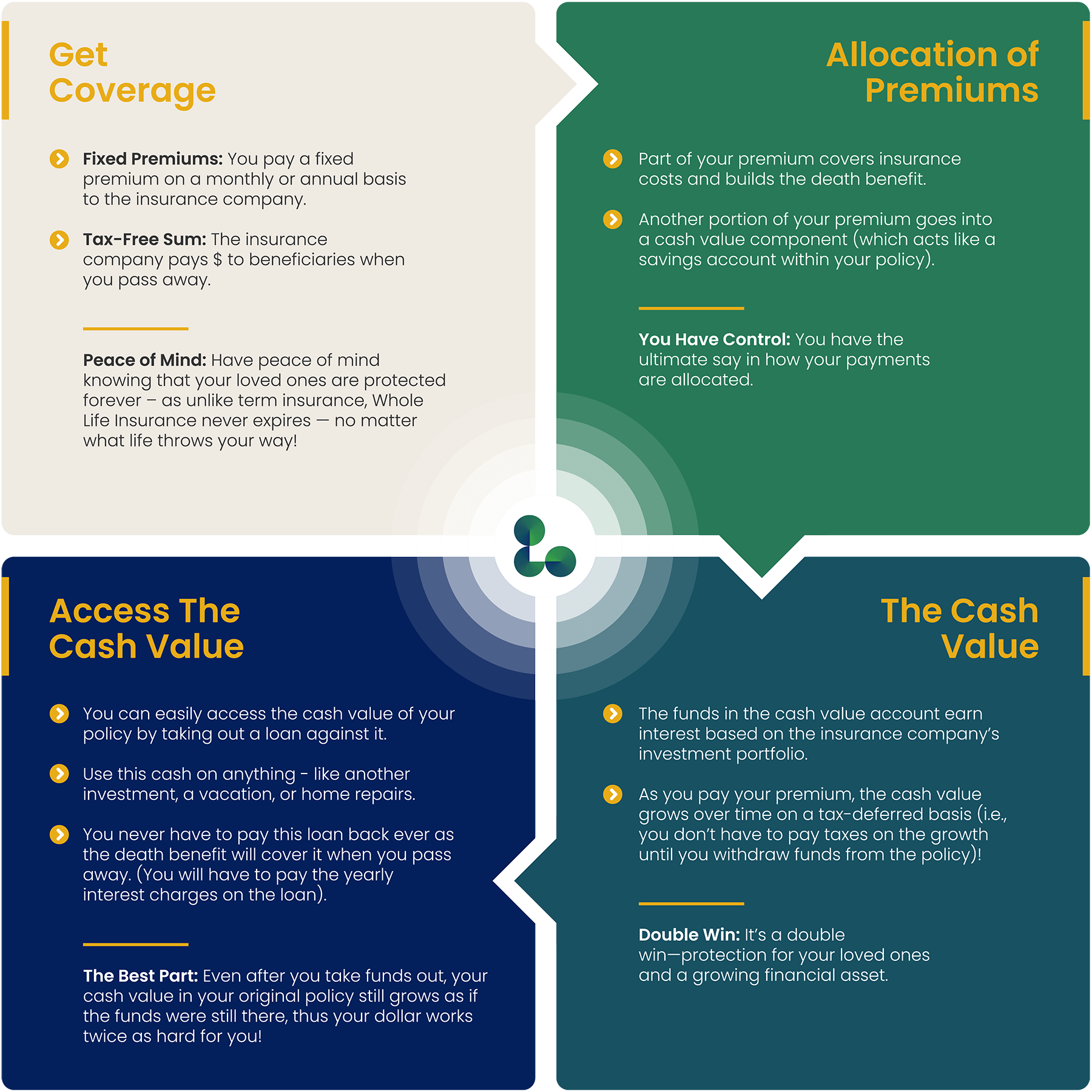

Whole Life Insurance* provides lifelong coverage from the moment you purchase the policy until you pass away. It also serves as a comprehensive solution for wealth accumulation and legacy planning.

* Whole Life Insurance sometimes goes by other names including: Infinite Banking, Permanent Life Insurance, Cash Value Life Insurance, Traditional Life Insurance, Straight Life Insurance, Ordinary Life Insurance, and Life Assurance.

What’s so special about Whole Life Insurance?

Cash Value Component

What sets Whole Life Insurance apart from others is its cash value component. Part of the premium you pay goes into a cash value account, which you can use as equity for loans or withdrawals.

Whole Life policies also generate dividends, which provides you with a share of the insurer’s profits. So your investment becomes not just a source of protection, but a financial resource as well.

Tax-Deferred Growth

Unlike investments (like stocks, bonds, and mutual funds) that require you to pay annual taxes on earnings, the cash value account in your Whole Life Insurance policy grows tax-deferred.

This means you don’t pay taxes on interest gains until you withdraw funds, so your investments can rapidly accumulate over time. Even better, you never have to pay the tax yourself, because it gets subtracted from your policy’s death benefit.

Guaranteed Death Benefit

You can’t predict when you’re going to die. So why do other types of insurance ask you to? Instead of limiting your coverage to a specific time frame and leaving your beneficiaries at risk, Whole Life Insurance guarantees a tax-free, lump sum payment regardless of when you pass away.

Here’s the best part: this benefit then pays off any loans you’ve taken from your cash value account and any taxes associated with your policy, so you don’t have to worry about settling debts or taxes.

Fixed Premiums

With most insurance policies, premiums fluctuate or rise due to factors like age, health, and lifestyle. But Whole Life Insurance offers a fixed premium rate. So regardless of changes in your circumstances, you can budget for it confidently, knowing your insurance costs won’t increase over time.

How Does It Work?

What are the benefits?

- Low-Risk Investment: In addition to providing coverage, Whole Life Insurance also acts as an investment vehicle with a reliable combination of growth and protection

- Tax Benefits: All the money that grows within the insurance policy is tax-free. If you’ve maxed out your RRSP and TFSA, Whole Life Insurance is a great addition to grow your investment portfolio.

- Fixed Premiums: Rest assured that your premiums will always stay the same, even if your health does not.

- Predictable Returns: Life insurance investments offer consistent and reliable returns, regardless of market conditions. This makes it a safe bet compared to volatile investments (such as stocks).

Why We Focus on Whole Life Insurance

Lifestyle Legacy specializes in taking full advantage of Whole Life Insurance as a powerful financial tool. We believe in the effectiveness of our product — we focus on Whole Life Insurance because we know it produces versatile financial solutions. There’s no need to complicate things.

From maximizing benefits to customizing policies for your unique circumstances, we know how to make Whole Life Insurance work for you. Let us show you how to leverage Whole Life Insurance to create generational wealth and uncover new financial opportunities to forge your legacy.

Have more questions? Check out our blog or FAQ to learn more. You can also contact us anytime.